Q. A company

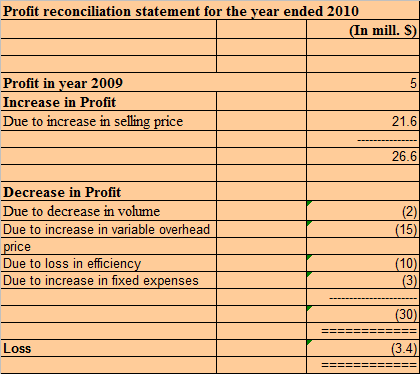

finds that it has incurred loss during the year 2010 to the extent

of $3.40 million as against a profit of $5 Million in 2009, despite

increase inselling price of its sole product to the extent of 20%.

The adverse situation is mainly attributable to the increase invariable costs and fixed costs, the increase over the previous years being onaverage 15% to 20% respectively. The following figures are extracted from the books of the company:

You are requested to analyse the variances relating to sales,fixed and variable overheads over the year in order to bring out thereason for the fall in profit.

Ans.

The increase in selling price = 20% ( Given )

Sales volume in 2010 = 129.6 (mill. $ )

Sales volume in 2009 = 120 (mill. $ )

Sales volume is a function of volume and selling price.

Sales volume = F(volume,selling price)

The sales volume in 2010 without increase in selling price would be = (129.6 * 100)/(100 + 20) = 108

Thus there is an actual reduction in sales volume from 2009 to 2010 = 120 - 108 = 12 ---------- (i)

The increase of 20% in selling price contributes purely to profit = 129.6 - 108 = 21.6 -----> (I)

Variable cost in 2009 for sales volume of 120 = 100

Variable cost in 2010 for sales volume of 108 = (108 * 100)/ 120 = 90 ----------- (ii)

The variable cost volume variance = 100 - 90 = 10 -------------------------------- (iii)

The increase in variable costs in 2010 = 15% (Given)

The variable costs without the increase of 15% =(115*100)/(100+15) = 100 ----- (iv)

The increase of $ 15 mill. due to increase of 15% in variable costs is the variable cost price variance.

Variable cost price variance = 115 - 100 = 15 (mill. $) ------------------------------------> (II)

From (ii) and (iv) we observe there is a difference of 10 (mill $)in the variable costs which is due to loss in efficiency and which contributes adversely to profit.

Thus Variable cost efficiency variance = 10 (mill. $) --------------------------------------> (III)

Also the reduction in sales volume would contribute adversely to profit, however as it also leads to decrease in material usage it would affect profit only to the extent of

12 – 10 = 2 (mill. $) (From (i) & (iii) ) ---------------------------------------------->(IV)

There has been an increase in fixed costs from 2009 - 2010 for an amount of 3 (mill. $) . This would again affect profit in an adverse manner.

The Fixed overhead expenditure variance = 18 -15 = 3------------------------------> (V)

The adverse situation is mainly attributable to the increase invariable costs and fixed costs, the increase over the previous years being onaverage 15% to 20% respectively. The following figures are extracted from the books of the company:

You are requested to analyse the variances relating to sales,fixed and variable overheads over the year in order to bring out thereason for the fall in profit.

Ans.

The increase in selling price = 20% ( Given )

Sales volume in 2010 = 129.6 (mill. $ )

Sales volume in 2009 = 120 (mill. $ )

Sales volume is a function of volume and selling price.

Sales volume = F(volume,selling price)

The sales volume in 2010 without increase in selling price would be = (129.6 * 100)/(100 + 20) = 108

Thus there is an actual reduction in sales volume from 2009 to 2010 = 120 - 108 = 12 ---------- (i)

The increase of 20% in selling price contributes purely to profit = 129.6 - 108 = 21.6 -----> (I)

Variable cost in 2009 for sales volume of 120 = 100

Variable cost in 2010 for sales volume of 108 = (108 * 100)/ 120 = 90 ----------- (ii)

The variable cost volume variance = 100 - 90 = 10 -------------------------------- (iii)

The increase in variable costs in 2010 = 15% (Given)

The variable costs without the increase of 15% =(115*100)/(100+15) = 100 ----- (iv)

The increase of $ 15 mill. due to increase of 15% in variable costs is the variable cost price variance.

Variable cost price variance = 115 - 100 = 15 (mill. $) ------------------------------------> (II)

From (ii) and (iv) we observe there is a difference of 10 (mill $)in the variable costs which is due to loss in efficiency and which contributes adversely to profit.

Thus Variable cost efficiency variance = 10 (mill. $) --------------------------------------> (III)

Also the reduction in sales volume would contribute adversely to profit, however as it also leads to decrease in material usage it would affect profit only to the extent of

12 – 10 = 2 (mill. $) (From (i) & (iii) ) ---------------------------------------------->(IV)

There has been an increase in fixed costs from 2009 - 2010 for an amount of 3 (mill. $) . This would again affect profit in an adverse manner.

The Fixed overhead expenditure variance = 18 -15 = 3------------------------------> (V)

No comments:

Post a Comment